Outdated or Unsupported Browser Detected

DWD's website uses the latest technology. This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website.

Frequently asked questions for fiscal agents about registering employers, reporting issues and closing employer's accounts for Wisconsin Unemployment Insurance (UI)

UI tax accounts are under the name of the person receiving the care in Wisconsin because they are considered to be the employer for Wisconsin Unemployment Insurance purposes. The individual will have the same UI account even if they switch fiscal agents. One account may have different fiscal agents over its lifetime because of this. Therefore, it is important to verify that the individual does not already have an account with us when they become your client.

Trusts are not domestic employers. If there is a Trust, the account should still be set up under the name of the individual receiving the services.

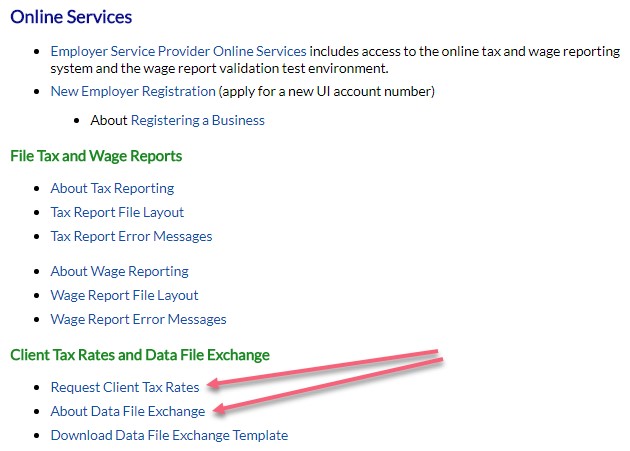

To determine if your new client(s) has an Unemployment Insurance account, use the Data File Exchange program on the Employer Service Provider (ESP) Resources page:

https://dwd.wisconsin.gov/uitax/esp-resource-page.htm.

You will need at least two of the following three identifying information:

The information will be returned in a file which can be retrieved on the next business day. Information provided in the returned file will include:

To retrieve the file:

Additional specifics on the data file exchange can be viewed by clicking on the "About Data File Exchange" link.

If your client does have an open account:

If your client does not have an account:

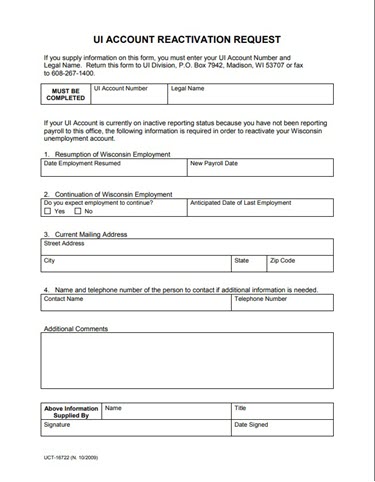

To reactivate an account, you can complete the UI Account Reactivation Request form located at https://dwd.wisconsin.gov/dwd/forms/ui/uct-16722.htm

No. When an account is in Preliminary Closed it means they are still subject to UI tax. Any resumption of payroll regardless of dollar amount needs to be reported and paid on, though you would first need to contact us with the new payroll date so that we could reopen the account. To do this you can complete the UI Account Reactivation Request form located at

https://dwd.wisconsin.gov/dwd/forms/ui/uct-16722.htm

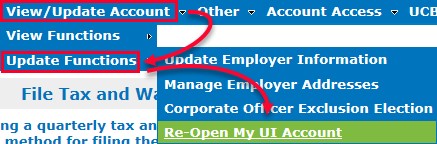

If you already have access to this account you can request the account be reactivated from their online account.

You can email these requests to taxnet@dwd.wisconsin.gov, fax to (608) 327-6158, or mail to:

DWD - UI

P.O. Box 7942

Madison, WI 53707

When sending Account Change forms and UI Account Reactivation Requests, you must send one email for each client. Do

NOT send all the Account Change forms for multiple clients in one email. Sending an Account Change form does not mean we will automatically send an access key, so be sure to include that request on the form or in the email.

When sending requests for Internet Access Codes only, you can send these in one email for multiple clients. Please include the employer's legal name and the UI account number. You can provide the information in the body of the email or as a spreadsheet.

If you have already updated the address on your client's account to your address, but are still needing an access key, you can request an access key on our website:

Note that the date of first payroll and liability are asking about dates and wages that have previously occurred. These questions are not to be answered as estimations of future wages or liabilities.

When this occurs, it means that there is already an account in our system with similar information. We call this partial matching. An analyst will manually review your registration and determine if a new account needs to be created for your client or if we already have an account for your client.

Domestic Employers might obtain a new Federal Employer Identification Number (FEIN) when switching fiscal agents. This can cause issues with our system identifying if it is the same employer or not and can cause our data file exchange system to fail in finding a previous account for an employer. Entering the employer's correct social security number during the registration will help us determine if it is the same individual or not.

We will contact you as soon as the registration is reviewed letting you know the status of the account. If we had to create a new account for your client a Subjectivity Initial Determination with an Access Key will be sent to you. If we already had an account we will be sending out just the Access Key, which will include the account number.

Please allow 7-10 business days prior to contacting our office.

The account status can also be verified via the data file exchange at any time.

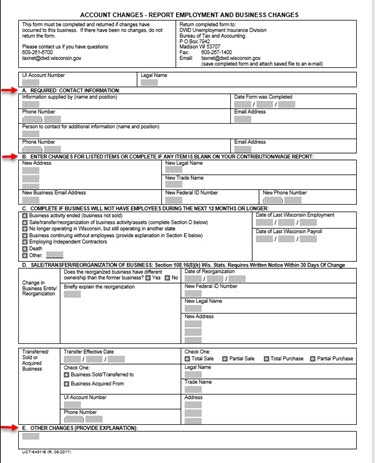

No, you should submit an Account Change form before submitting reports.

If you are submitting the reports via the online portal, wait until you receive the access keys before submitting the reports. Do NOT submit paper reports. Third parties are required to submit quarterly reports electronically and will be assessed a penalty if they report by paper

If you are submitting the reports via upload, submit the account change forms before completing the upload.

Yes, you still need to report those wages to us. If a client changes fiscal agents mid-quarter, it's common for two sets of wages to need to be filed. You should submit adjustment reports for that quarter rather than submitting new quarterly reports.

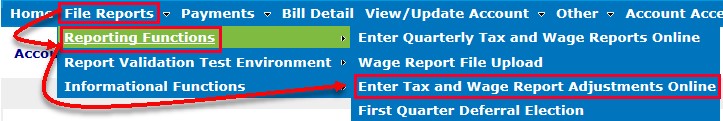

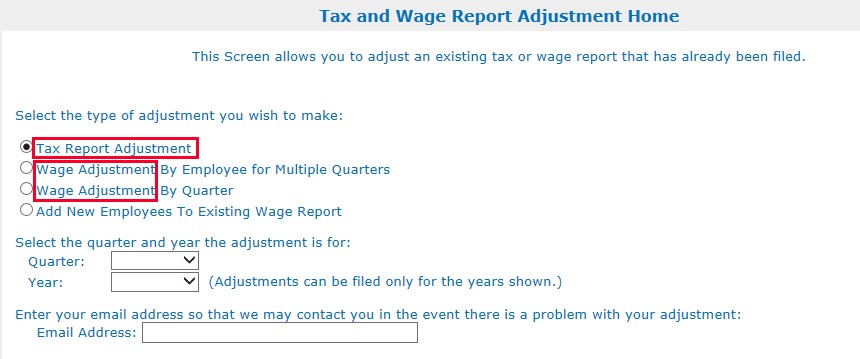

You can submit the adjustments either by paper or through the online portal. Both the Tax Report Adjustment and the Wage Adjustment need to be made.

You can also view what was reported by the previous fiscal agent online.

Liability is retroactive to the first of the year. This means that even if you do not meet liability conditions until the 4th quarter, you are still liable for all the wages paid that year. You must report the wages to the correct quarter in which they were paid.

It is important to give the correct date of first payroll so that we can allow you to file all past quarters accurately.

Certain family members are excluded from Unemployment Insurance. Effective 01/01/2011, family members that are excluded include the individual's spouse, parent, child, grandparent, or grandchild. All of these can be by blood or adoption. The expanded family exclusions apply only when personal care or companionship services are provided by an individual to an ill or disabled family member.

If the relationship is excluded, this employee should not be included on the quarterly tax and wage reports.

An individual's step parent or step child are also excluded. However, step-grandchildren and step-grandparents are not excluded.

Domestic Partners who have filed a declaration of domestic partnership in their county of residence are excluded.

Be sure to know the actual relationship the worker has to the client so that you can inform us, if requested.

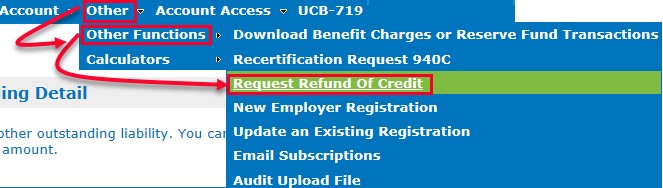

You can request a refund on the online portal.

The payee must be the client and we cannot change it to the fiscal agent. However, you can

If the credit is under $10.00 and you are still the fiscal agent for the client, then you should apply the credit to future tax liabilities.

Yes, you need to contact us in writing if you are no longer the fiscal agent for the client. You can notify us either electronically or by paper:

Both requests (online or paper) should indicate (to the best of your knowledge) why the employer is no longer your client – i.e. passed away, moved to nursing home/permanent care facility, switched fiscal agents (provide new fiscal agent information if known), disenrolled). In the case that the employer disenrolled from your program, please provide the last known contact information of the employer (i.e. home address)

If you have online access to the employer's account, you can revoke your access online:

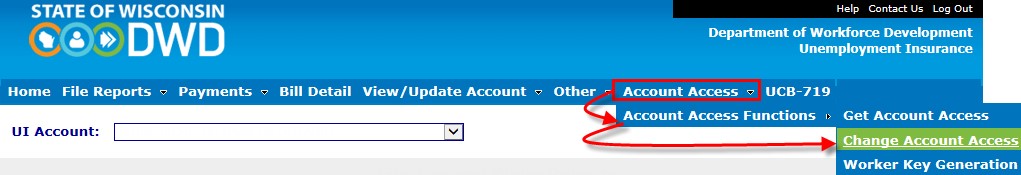

Under Account Access > Account Access Function > Change Account Access

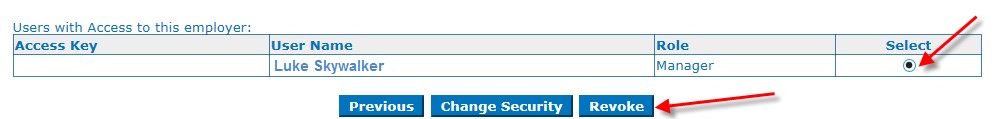

Choose the User and click Revoke

If they are no longer your client leave the estimates on the account. If you try filing reports showing zero wages paid in those quarters you are providing us with false information. We do not know if the client has continued with a new fiscal agent and the zero report may cause issue if they try reporting those wages.

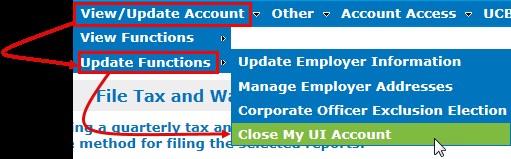

If you are trying to close the account from the online portal, then put today's date for the last payroll and employment dates. Then in the comments, supply the correct last payroll and employment dates.

If they are still your client, but they are now deceased, moved into a nursing home, etc. you can remove the estimates on the account by filing the missing reports. You will then be able to put the correct dates of last payroll and last employment on the online form.

Aligning state law with federal law so that a private agency that serves as a fiscal agent, or that contracts with a fiscal intermediary to serve as a fiscal agent, may be found jointly and severally liable with respect to the unemployment tax liability of a domestic employer. This will provide an incentive for fiscal agents to correctly report wages for employers and to properly pay UI tax.

You will not be fined for periods after you have ceased representing them as a fiscal agent; however, this dependent upon the fiscal agent notifying the department that they are no longer representing that employer.

Yes, if the client has not paid $1,000 in a quarter for any entire calendar year (January 1st – December 31st) then you can request the account to be closed.

The account will be closed as of December 31st of the most recent calendar year in which they did not meet the liability conditions.