Outdated or Unsupported Browser Detected

DWD's website uses the latest technology. This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website.

Most Wisconsin employers are subject to the Worker's Compensation Act (Act), including the requirement to obtain Worker's Compensation insurance. But, there are exceptions to this principle of universal coverage, including:

Non-Farm Employers Required to Insure. A non-farm employer who usually employs 3 or more full-time or part-time employees becomes subject to the Act and is required to obtain insurance. An employer who pays combined gross wages of $500 or more in a calendar quarter is also required to obtain insurance.

Farmers Required to Insure. There is no wage threshold for farmers. It does not matter how much a farmer pays in wages. What matters is the number of employees, after excluding certain employees who are family members, relatives or "exchanged workers" as described in more detail below.

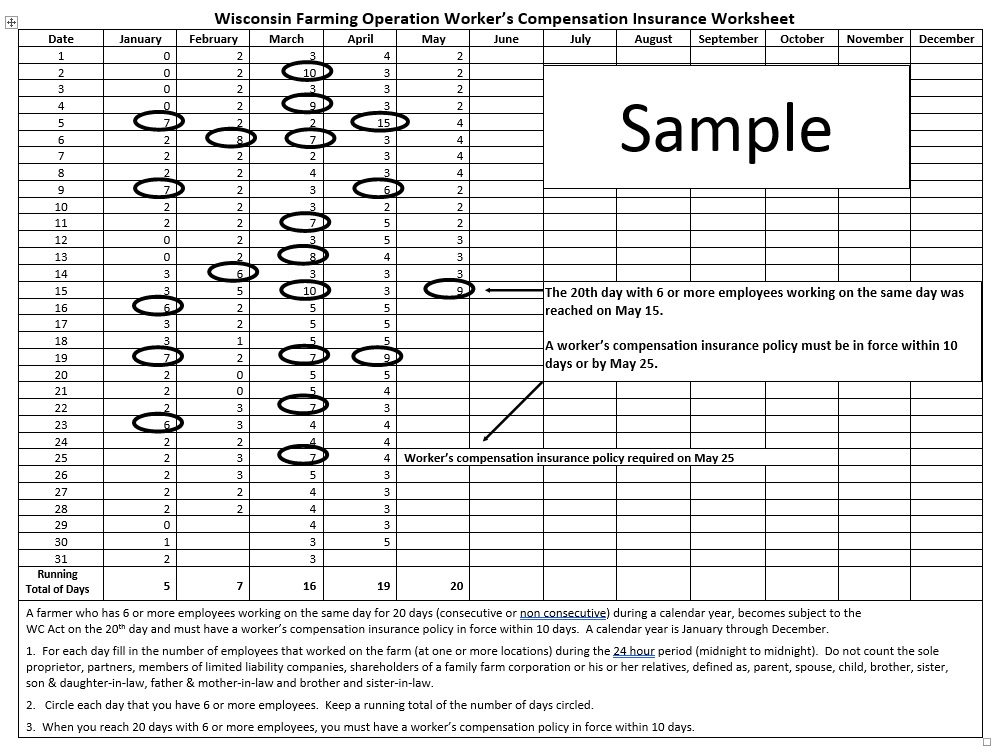

For farmers, the threshold is 6 employees, not 3 employees. However, farmers are not required to obtain insurance unless they have 6 or more employees on at least 20 days during a calendar year. After the 20th day, farmers have 10 days to obtain insurance.

Example #1: Farmer Pat had 5 employees every day in January and February. Pat had 6 employees on 17 dates in March and 5 employees every day April through December.

Analysis: In January, February and April through December Pat had 5 employees every day, but none of those days count toward the 20-day threshold because there is no day that Pat had 6 employees. Pat had 6 employees on only 17 days during the calendar year and therefore, is not required to obtain a worker's compensation insurance policy.

Example #2: Farmer Chris had no employees in January or February. Chris had 6 employees (4 worked full-time and 2 worked part-time) on 3 dates in March, on 7 dates in April, on 9 dates in May, and on 10 dates in June, starting on June 3rd.

Analysis: In March, April and May there were 19 total days on which Chris had 6 employees. Any combination of new, old, part-time or full-time employees are counted the same way. June 3rd is the 20th day during the calendar year on which Chris had 6 employees. This means that 10 days later, on June 13th, Chris is subject to the Worker's Compensation Act. Chris must have a worker's compensation policy in force by June 13th.

Answer: The statutory definitions of farming[1], farm premises[2], farm operations[3] and farmers[4] are extremely broad. The law has a long list of farm operations related to plant and animal commodities that cover everything from cultivating, breeding, tending, raising, training, managing and harvesting--to processing, drying, packing, packaging, freezing, grading, storing, delivering, distributing, or marketing. The law also says that farming shall also include "any other activities commonly considered to be farming whether conducted on or off (farm) premises."

[1]"Farming" means the operation of farm premises owned or rented by the operator. [s. 102.04(3), Wis. Stats.]

[2]"Farm premises" means areas used for operations listed in footnote 3 but does not include other areas, greenhouses or similar structures unless used principally for the production of food and farm plants. [s. 102.04(3), Wis. Stats.]

[3]Operation of farm premises shall be deemed to be the planting and cultivating of the soil thereof; the raising and harvesting of agricultural, horticultural or arboricultural crops thereon; the raising, breeding, tending, training and management of livestock, bees, poultry, fur-bearing animals, wildlife or aquatic life, or their products, thereon; the processing, drying, packing, packaging, freezing, grading, storing, delivering to storage, to market or to a carrier for transportation to market, distributing directly to consumers or marketing any of the above-named commodities, substantially all of which have been planted or produced thereon; the clearing of such premises and the salvaging of timber and management and use of wood lots thereon, but not including logging, lumbering or wood cutting operations unless conducted as an accessory to other farming operations; the managing, conserving, improving and maintaining of such premises or the tools, equipment and improvements thereon and the exchange of labor, services or the exchange of use of equipment with other farms in pursuing such activities. The operation for not to exceed 30 days during any calendar year, by any person deriving the person's principal income from farming, of farm machinery in performing farming services for other farms for a consideration other than exchange of labor shall be deemed farming. Operation of such premises shall be deemed to include also any other activities commonly considered to be farming whether conducted on or off such premises by the farm operator. [s. 102.04(3), Wis. Stats.]

[4]"Farmer" means any person engaged in farming as defined in footnotes 1 to 3. [s. 102.04(3), Wis. Stats.]

Answer: If makes no difference whether the farmer owns or rents the farm premises. The same broad exemptions from the requirement to obtain insurance apply.

Answer: It does not matter. There is no requirement that the farmer actually succeed in making a profit on raising any crop, animal, animal product or commodity.

Answer: "Logging, lumbering or wood cutting" operations are not, by themselves considered farm operations. However, if they are done as part of other farm operations, they are considered farm operations for all worker's compensation purposes. On the other hand, clearing farm premises, salvaging dead timber and managing and using wood lots are, by themselves, considered farming. They are not considered "logging, lumbering or wood cutting."

Answer: Commercial threshers, clover hullers, silo fillers, corn shredders and other employers who work for farmers are not considered to be engaged in farming operations. These contractors become subject to the Worker's Compensation Act like any other non-farm employer. These employers and their employees are not counted for purposes of determining whether a farmer has 6 employees.

Answer:

A. Eligibility for benefits. The most important thing to remember is that the special rules for relatives relate only to counting, not to benefits or insurance premiums. Put simply, all these rules mean is that certain relatives are not counted when deciding whether a farmer has crossed the 6-employee threshold.

However, once it is determined that a farmer is subject to the Worker's Compensation Act--at which time the farmer must obtain insurance--then all employees of the farmer (including all the relatives who were not counted for purposes of determining whether that insurance was required) are covered under that policy. This means, quite properly, that the farmer's insurance premiums will be based on all wages paid by the farmer to all employees--including these relatives.

B. Counting toward the 6-employee threshold. When determining whether a farmer has 6 or more employees, the law says that certain direct ancestors and descendants of the farmer ("lineal" relatives) and certain more distant familial relatives and in-laws ("collateral" relatives) shall not be counted. The list in Table 1 applies to all farmers. For purposes of counting, these relatives are not employees.

If the farm operation is a sole proprietorship, the relatives of the owner listed in Table 1 are not counted when counting the number of employees.

If the farm operation is a partnership, the relatives of a partner listed in Table 1 are not counted when counting the number of employees.

If the farm operation is a limited liability company, the relatives of a member of the limited liability company listed in Table 1 are not counted when counting the number of employees.

If the farm is a family farm corporation[5] , relatives of a shareholder listed in Table 1 are not counted when counting the number of employees.

Important Note: If the farm is a corporation, (where all shareholders are not related as lineal ancestors or descendants) all employees including the relatives of a shareholder listed in Table 1 are counted when counting the number of employees.

[5]A "family farm corporation" means a corporation engaged in farming all of whose shareholders are related as lineal ancestors or lineal descendants, or as spouses, brothers, sisters, uncles, aunts, cousins or in-laws (listed in Table 1) of such lineal ancestor or descendant. [s. 102.07(5)(c), Wis. Stats.]

Answer: No, relatives cannot be excluded from coverage. The policy covers all employees including your relatives. Insurance premium will be charged on all of your employee's wages including any relatives that work for you. Only two corporate officers of a closely held corporation and members of a qualified religious sect who are certified for exemption by the department may be excluded from coverage. All other employees are covered.

Answer: Employers may apply for an exemption from the duty to insure workers who belong to a religious sect, such as Amish or Mennonites, whose tenets and teachings oppose accepting benefits of any public or private insurance payments for death, disability, old age, retirement or that makes payments towards the cost of medical care, including federal social security benefits.

The exemption is not automatic. It applies only if all the following occur: (1) the employer applies for an exemption (2) the religious sect has a long standing history (25 years is presumed to be long-standing history) of providing its members who become dependent on the sect as a result of work-related injuries, with a standard of living and medical treatment that are reasonable when compared to the general standard of living and medical treatment for members of the religious sect (3) the worker waives their rights to WC and requests an exemption (4) the religious sect agrees to pay benefits at a reasonable standard of living and medical treatment when compared to the general standards for members of the sect. To qualify for this exemption, employers must apply to the WC Division. Contact the WC Division to request the religious sect exemption forms and related informational materials

Answer: Yes, all employers, including farmers, may voluntarily elect coverage for themselves or their employees. In the event of a work-injury, they are eligible for all medical, wage and other worker's compensation benefits, without regard to who was at fault in causing the injury. The voluntary purchase of a worker's compensation policy also protects the employer from most civil tort actions by employees related to the work-injury. With few exceptions, where the employer has the worker's compensation insurance coverage in place, an injured worker is limited to the benefits to which they are is legally entitled under the Worker's Compensation Act.

Answer: Whenever anyone voluntarily elects coverage, whether purposely or by mistake--and assuming that during the period for which voluntary coverage is obtained the farmer does not otherwise become subject to the Act by having 6 or more employees on 20 days during a calendar year--the person may cancel that policy at any time. There is no waiting period.

Answer: A special law applies to farmers who exchange workers. For purposes of counting, your neighbor and their employees are not counted toward your 6-employee threshold. Your neighbor's employees are counted only by your neighbor to determine whether they have 6 employees on 20 days and is subject to the Act.

Answer: Quite a while. Once a farmer is required to obtain insurance, even if they permanently drop below 6 employees, the farmer must maintain the insurance for the remainder of that calendar year--and for the next calendar year--before they are eligible to withdraw from being subject to the provisions of the Act.

Once the farmer has gone a full calendar year without employing 6 or more employees on 20 days, the farmer may drop insurance coverage by first filing a notice of withdrawal with the Worker's Compensation Division, and then waiting 30 days. If the withdrawal is approved by the Department, the farmer must notify the insurance carrier of the date they want the coverage cancelled. If, for some reason, the farmer wants to drop coverage more than 30 days later, the later date should be specified in the notice of withdrawal. Farmers should contact the Worker's Compensation Division for the necessary withdrawal forms.

Example: On July 8, 2016, Farmer Pat drops from 25 employees to 5 employees. During the rest of 2016 there are 23 dates on which Pat has 6 or more employees. In 2017, there are only 19 days on which Pat has 6 or more employees. What is the earliest date Pat can drop the insurance coverage?

Analysis: The 23 days in 2016 after July 8th are irrelevant. What matters is that during 2017 Pat did not have 6 employees on 20 days. The earliest Pat is eligible to file a notice of withdrawal is January 1, 2018. January 1st is a holiday and state offices are closed. The earliest the notice can be received by the Worker's Compensation Division is January 2, 2018. The earliest the insurance coverage can be cancelled is 30 days later, or February 1, 2018.

Answer: A farmer who fails to have insurance coverage when they are subject to the law will be penalized the same as any other employer.

Farmers who are subject to the law, but do not carry worker's compensation insurance, are personally responsible for the terms of the Worker's Compensation Act. If a worker is injured, the employer is personally liable, and the usual personal exemptions of property from seizure and sale on execution of a judgment do not apply.

Farmers who are not subject to the law and do not carry worker's compensation insurance may be sued in a civil action for damages by an employee who is injured while at work.

Answer: The penalty is twice the amount of the premium not paid during an uninsured time period, or $750, whichever is greater.

Under certain circumstances, an employer who has a lapse in worker's compensation coverage of 7 days or less can be subject to a penalty of $100 for each day they are uninsured, up to a total of 7 days ($700).

In addition, an uninsured employer is personally liable for reimbursement to the Uninsured Employers Fund for benefit payments made by the Fund under section 102.81(1) of the Wisconsin Statutes to an injured employee (or the employee's dependents) of the uninsured employer. (See section 102.82(1) of the Wisconsin Statutes.) The penalties and reimbursements to the Fund are mandatory and non-negotiable.

Answer: Contact the Wisconsin Department of Workforce Development - Worker's Compensation Division, Bureau of Insurance Programs in-person at GEF-1 State Office Building, 201 E. Washington Avenue, Madison by mail at P.O. Box 7901, Madison, WI 53707-7901 or by phone at (608) 266-3046. The Division also offers information online at: http://dwd.wisconsin.gov/wc

DWD is an equal opportunity employer and service provider. If you have a disability and need assistance with this information, please dial 7-1-1 for Wisconsin Relay Service. Please contact the Worker's Compensation Division at (608) 266-1340 to request information in an alternate format, including translated to another language.

The Division also produces a variety of printed informational materials to help employers and workers better understand and comply with the WC law. Single copies are available for free upon request. Among the most often-requested are these:

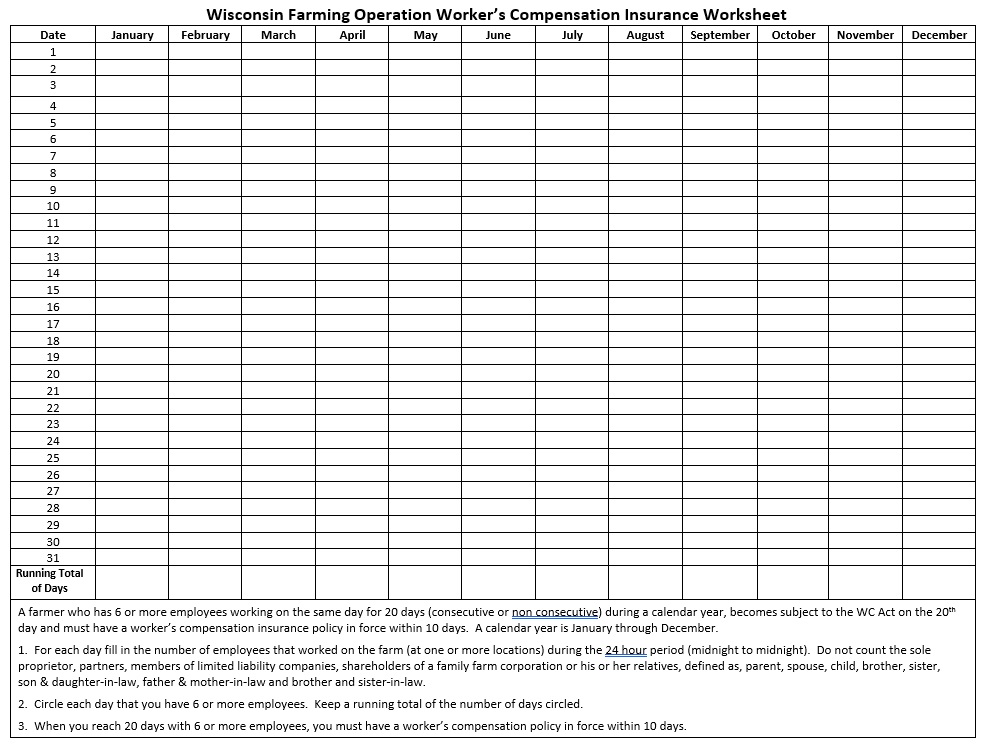

Answer: On the following two pages you will find a Wisconsin Farming Operation Worker's Compensation Insurance Worksheet (a sample worksheet and a blank worksheet) to help you determine if you employ enough employees on enough days in a year to require worker's compensation insurance.

WKC-10447-P (R. 10/2024)